Preparing Great Britain’s Distribution Networks for Net Zero

-

27 February 2025

Key Insights from Our National Capacity Analysis

The transition to net zero by 2050 presents one of the greatest infrastructure challenges in modern times. As Great Britain accelerates the adoption of low carbon technologies (LCTs) such as electric vehicles (EVs), heat pumps, and rooftop solar panels ensuring that electricity distribution networks can accommodate these changes is critical.

At EA Technology, we recently partnered with Regen to conduct an in-depth Electricity Distribution Network Capacity Analysis for the National Infrastructure Commission (NIC). This project explores the future of electricity networks, identifying potential bottlenecks and providing strategic recommendations for reinforcement and flexibility.

This work forms part of the NIC’s broader remit, set out by HM Treasury in 2024, to assess the challenges of preparing Great Britain’s electricity distribution networks for the net-zero transition.

The remit aimed to assess the load-related expenditure required to electrify heat and transport, enabling the delivery of a Net Zero power system [Terms of reference – distribution networks study - GOV.UK]. Additionally, the NIC’s remit included evaluating the policy and regulatory frameworks that guide how network companies invest in and operate their infrastructure. The study also explored the opportunities presented by flexibility and smarter network solutions, while considering the roles of key stakeholders such as Ofgem, Distribution Network Operators (DNOs), and the new Regional Energy Strategic Planning (RESP) function within the National Energy System Operator (NESO).

EA Technology’s Role in the Project – National Modelling:

Our team at EA Technology were responsible for delivering the technical modelling aspects of the project, providing critical analysis and insights to inform future distribution network investment.

- EA Technology conducted the national modelling using our Transform Model® (Transform model Brochure | EA Technology), a well-established tool used by network operators and policymakers to assess future network capacity requirements. The model simulated year-by-year growth in electricity demand and its impact on the distribution network capacity and investment needed from now to 2050.

- Regen provided the input scenarios and load profiles, drawing from the 2023 Future Energy Scenarios (FES) and specific data helpfully provided by Distribution Network Operators (DNOs). Using these inputs, EA Technology assessed how the uptake of LCTs—such as EVs and heat pumps—would affect network capacity across Great Britain.

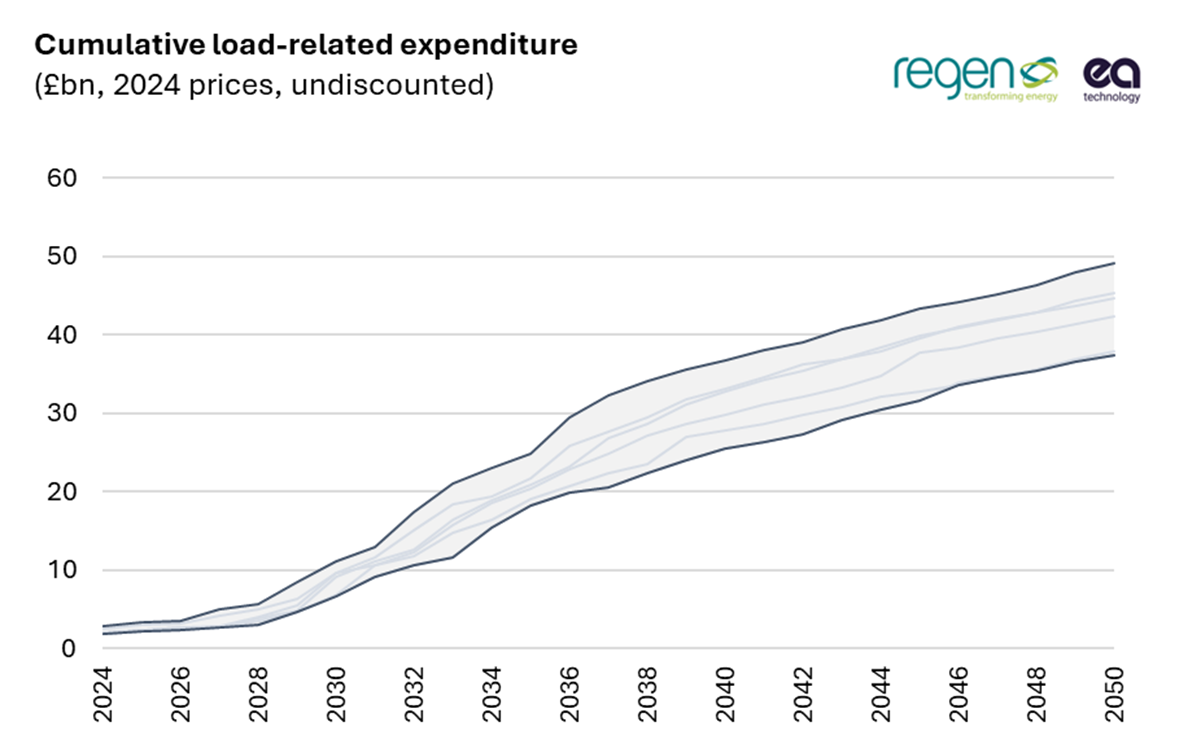

- The national modelling quantified the load-related expenditure (LRE) needed to support increased demand at low voltage (LV), high voltage (HV), and extra high voltage (EHV) levels. This analysis factored in different adoption rates of heating technologies, varying levels of operational flexibility, and potential demand-side responses.

- Our work explored a range of investment horizons and reinforced the importance of flexibility services, which can reduce the scale of required infrastructure upgrades by shifting peak demand or optimising existing capacity. The modelling also highlighted key stress points in the network under high-demand scenarios, such as a winter stress test resulting in higher heating demand.

Key Findings:

- Projected Investment: Between £37 billion and £49 billion in cumulative investment will be necessary to meet growing demand across all voltage levels, excluding 132 kV networks.

- Electrification of Heat and Transport: The widespread adoption of EVs and Heatpumps is projected to drive peak demand from 57 - 58GW to between 108GW - 119GW by 2050.

- Flexibility as a Solution: In scenarios with higher levels of operational flexibility, investment requirements were up to 20% lower, demonstrating the importance of demand-side response, smart grids, and distributed storage.

- Extreme Conditions: Sensitivity studies were included to test extreme conditions such as sustained, cold spells. The results highlighted the challenges in designing, planning and delivering enough capacity for these conditions. This highlighted a need for further work in this space to reduce the impact and better understand network resilience requirements.

🔍 Curious how your electricity network could handle the increasing demand from heat pumps and EVs? Our Transform Model® can provide tailored insights into future load growth and investment planning.

For a deeper dive into our findings, download the full project report here.

EA Technology’s Transform Model® and VisNet Design® have been instrumental in helping network operators and policymakers navigate the complexities of the energy transition. If you are interested in leveraging these tools to optimise your network planning, we invite you to get in touch and discuss how we can support your projects.

Acknowledgements

This work forms part of the NIC’s broader remit, set out by HM Treasury in 2024, to assess the challenges of preparing Great Britain’s electricity distribution networks for the net-zero transition.

The remit aimed to assess the load-related expenditure required to electrify heat and transport, enabling the delivery of a Net Zero power system [Terms of reference – distribution networks study - GOV.UK]. Additionally, the NIC’s remit included evaluating the policy and regulatory frameworks that guide how network companies invest in and operate their infrastructure. The study also explored the opportunities presented by flexibility and smarter network solutions, while considering the roles of key stakeholders such as Ofgem, Distribution Network Operators (DNOs), and the new Regional Energy Strategic Planning (RESP) function within the National Energy System Operator (NESO).Additionally, the NIC’s remit included evaluating the policy and regulatory frameworks that guide how network companies invest in and operate their infrastructure. The study also explored the opportunities presented by flexibility and smarter network solutions, while considering the roles of key stakeholders such as Ofgem, Distribution Network Operators (DNOs), and the new Regional Energy Strategic Planning (RESP) function within the National Energy System Operator (NESO).